Welcome to Michigan United

When we fight, we win

Join Project 3.5

We want to organize 3.5% of Michigan, tear down the barriers of inequality and replace it with dignity and opportunity.

Recent News & Media

- All

- Demo

- Blog

- Movement Politics

- News & Media

- Statewide

- Detroit

- Eastern Michigan

- Resistance

- Immigrant Rights

- Immigration

MU in the News: “Resist: Juneteenth 2025” in the Detroit News

Read what the Detroit News said about the kickoff of our "Resist:Juneteenth 2025 Week of Resistance" event.

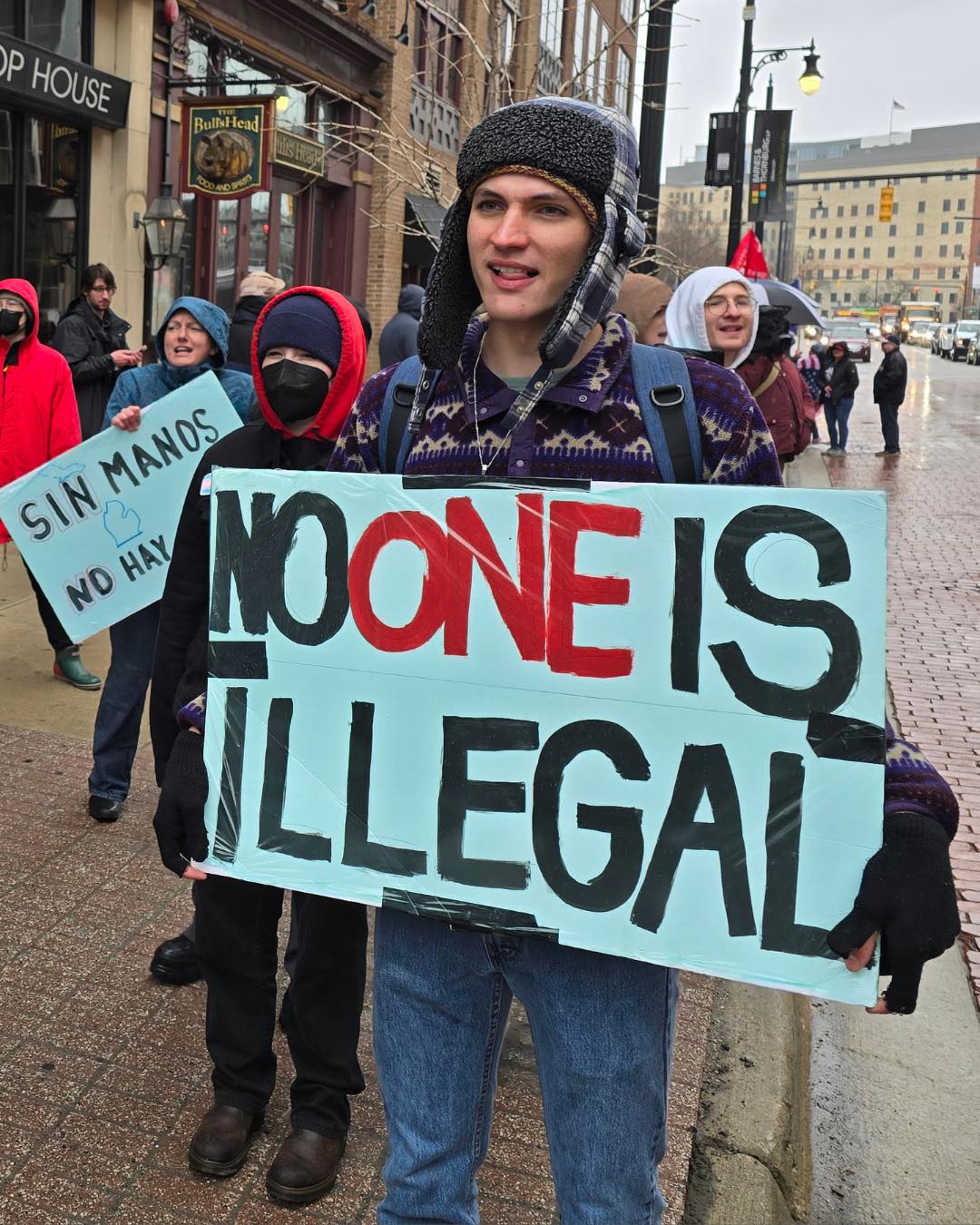

MU in the Streets: Images from “NO KINGS” 2025

Michigan United and Michigan United Action were out organizing and supporting the people.

NO KINGS DETROIT is Coming Saturday

Please join Indivisible, 50501, and the May Day coalition for a rally and a short march that celebrate our diversity and shame autocrats.

Grassroots Power in Action: Why Neighborhood and Community Organizing Matter More Than Ever

Discover how grassroots organizing and community building empower people to drive real change, fight injustice, and protect democracy.

Juneteenth 2025 is Eleven Days Away. Register Now!

This Juneteenth, we're not just celebrating our ancestors' freedom. Our theme this year is "Resist." Tap for events from June 13th to 21st

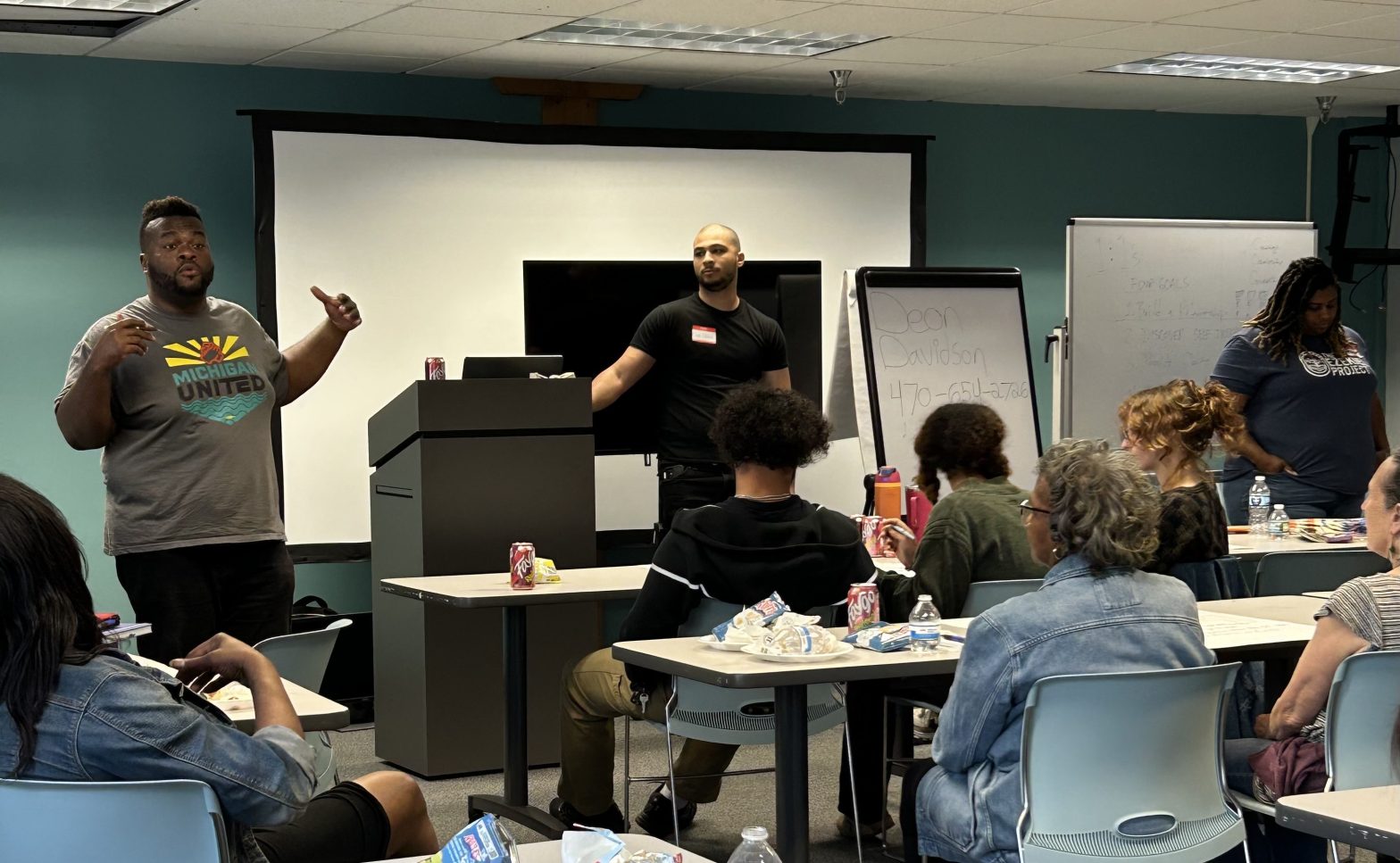

MU Saginaw/Bay City Justice Assembly Recap: Community, Strategy, and Next Steps

Last week, Saginaw and Bay City residents gathered for the MU Justice Assembly—a space to reflect, connect, & plan for change. Join us at our next meeting

MU Healthcare in Flint: Launching the Improve Hypertension Health Initiative

Last weekend, we helped launch the Improve Hypertension Health Initiative. The program addresses hypertension in the most at-risk communities in Flint.

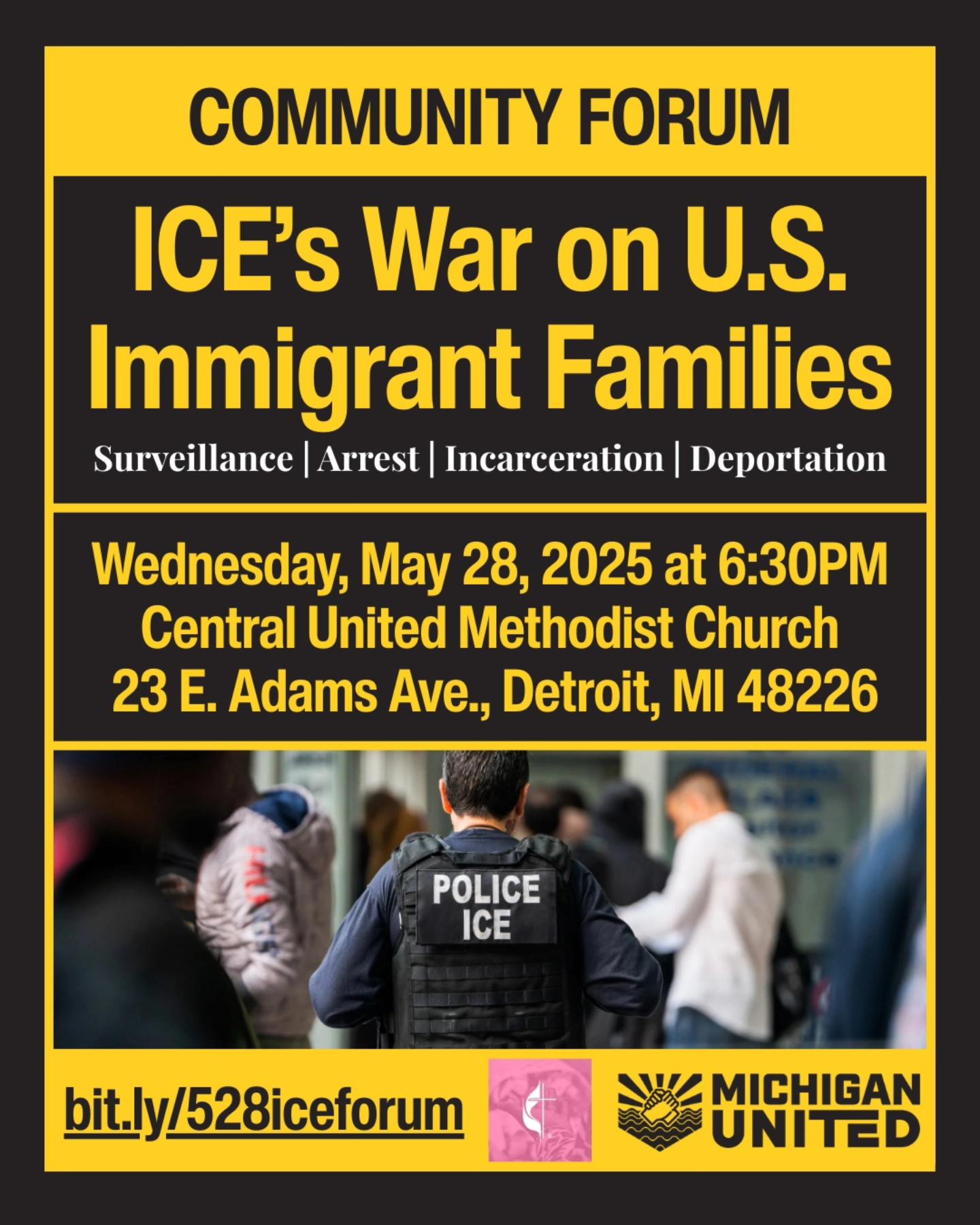

MU in the News: Talking about ICE’s War on Immigrant Families on WDIV-4

Michigan United was on WDIV 4. They covered our forum on ICE and what they're doing in our state and the US. Tap to watch.

How Administration Policies on Medicaid, Social Security, and Tariffs Will Harm Working-Class Americans

Here’s how these key policies would directly harm millions of families, seniors, and low-wage workers across the country.